A Processor is a generic term that everyone uses to identify themselves in this industry. In other words, an ISO will say they are a processor, as will an MSP, etc.

A Processor is like:

First Data, which has been acquired by Fiserv, a software company.

_____________________________________

worldpay/vantiv, was acquired by FIS, a banking/ investing software tech company). Now (Sept 2023), FIS has just sold off Worldpay to a private equity firm.

Advent International (a private equity group) acquired Fifth Third Processing Solutions in 2009 and renamed it Vantiv, then acquired worldpay in December of 2010.

______________________________________

Chase – Paymentech – Chase was reselling First Data, and in 2002 had a falling out, and acquired Paymentech in 2002.

______________________________________

Global – Acquires Heartland in December 2015. Heartland started back up as Beyond an ISO for Merrick Bank.

TSYS acquires Transfirst January 2016 and CYAN in 2018

Global and TSYS merge May 2019.

_______________________________________

Elavon is a joint venture with US Bank.

_________________________________

BAMS (Bank of America Merchant Services) – A joint venture between BOA and First Data. However, BOA announced this year (2019) they are looking to part ways with First Data.

_____________________________________

There are a couple more that are not currently listed, but the above make up about 90%, if not more, of the market.

______________________________________

An ISO is an “Independent Reseller Organization). That resells merchant processing, like:

FattMerchant An ISO for Wells Fargo, they charge a flat rate versus a % for a Discount Rate.

Flagship

Solupay

Blue (owned by First Data)

CardConnect (owned by First Data)

Total Merchant Services

There are about 1,000 ISO’s in America.

An ISO is supposed to disclose who they represent at the bottom of their website.

Most are an ISO for Wells Fargo (First Data).

Processors have to have what’s called a sponsoring bank to play, as credit cards are owned by banks. So in order to get a seat at the table, a processor has to have a bank sponsor them. Wells Fargo is First Data’s sponsor which is why you see Wells Fargo name instead of First Data.

MSP Merchant Service Providers

Banks other than Chase Paymentech, which is a processor and BOA (BAMS), are MSPs. They are the same thing as an ISO except they are banks.

However, they are still reselling this service – to find who, just Google – like the example below.

I’m not sure who comerica is reselling so I can Google “comerica merchant services (then just trade out Vantiv or First Data etc..) to see who they have partnered with.

Examples –

Commerce Bank

Suntrust

PNC

City

The content below this line is next to worthless information that you will most likely never discuss with anyone. If you do, rest assured, they know way more, so gracefully thank them and remind them that the conversation is about the fees, and let’s please stay on point.

Acquire – just what it says, but it is a word (term) you will hardly ever hear used. It is who “Acquires” the transactions, or what is often times called the front end. This is who sends the transaction to the processing Networks (visa, MC, Discover, or Amex) to get an approval.

Settlement – or what’s called the back end. This is who moves the cash.

More times than not, it is the same Processor; but sometimes due to IT or integrations limitations, it will be split between two processors. Now that is very rare!

The one who issues the credit card, which is Bank of America in the case below.

Unfortunately, we are a privately held company and do not disclose that information. Given the nature of our business, we prioritize confidentiality and operate on a need-to-know basis. While our website shares what we can, if it’s not listed there, we don’t discuss it. You might say that privacy is our currency.

It typically takes 7-10 days, depending on how busy our auditors are at the time. We’ll keep you updated throughout the process to ensure everything stays on track.

POS (Point of Sale) – Typically used in retail or restaurants, where face-to-face interactions occur.

ERP (Enterprise Resource Planning) – Generally used in B2B environments. While some face-to-face interactions happen, it is often not the case. ERPs are most common among smaller manufacturers and distributors because they are typically out-of-the-box, ready-to-use systems.

SAP (Systems, Applications, and Products) – Designed for large companies, SAP manages every aspect of an enterprise. It is costly to purchase, maintain, and customize, but it offers extensive capabilities.

CRM (Customer Relationship Management) – Primarily used by companies offering services rather than products. A popular example of a CRM is Zoho.

Notice that each description starts with “typically” because there are no absolute scenarios. What’s critical to understand is whether the merchant is integrated. Is their ERP, or another system, locked down to a single gateway, or do they have options?

Also, unlike other systems, SAP has no inherent limitations. Although expensive to program and modify, it offers flexibility without restriction.

If the merchant is not integrated, it doesn’t matter whether they have a POS, ERP, or other systems.

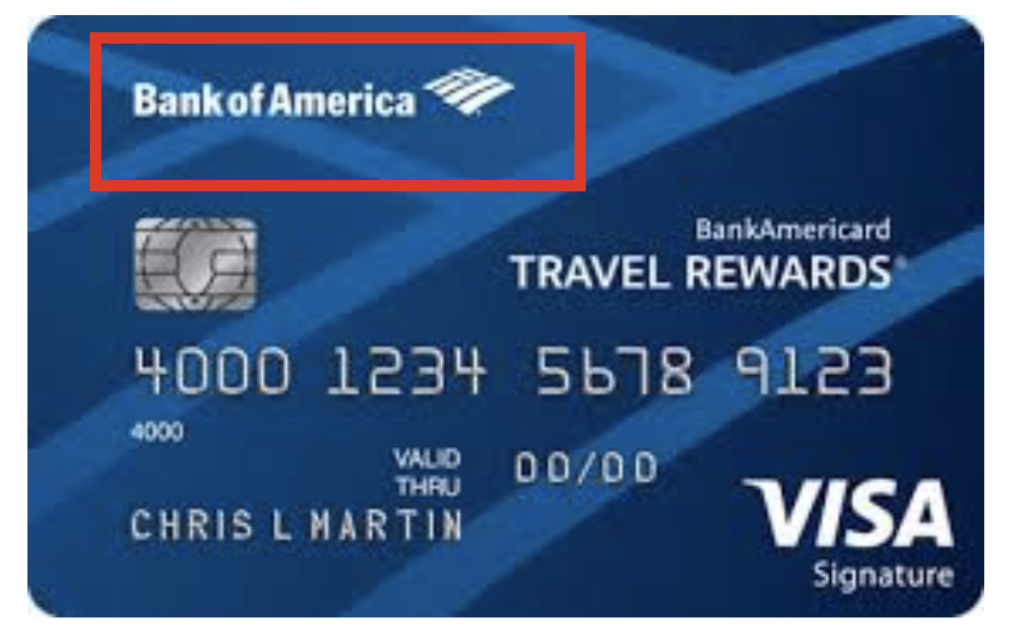

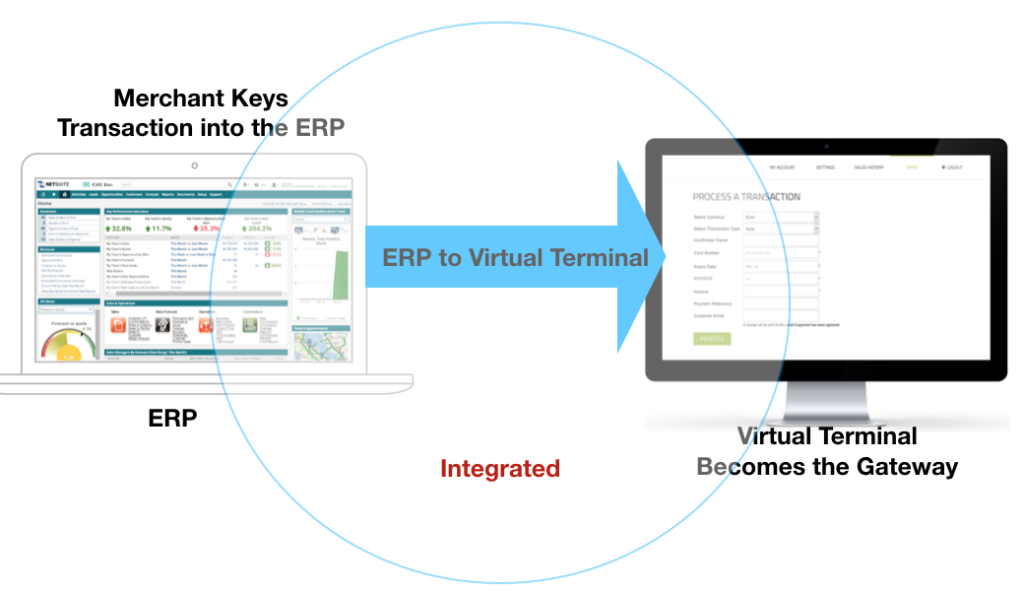

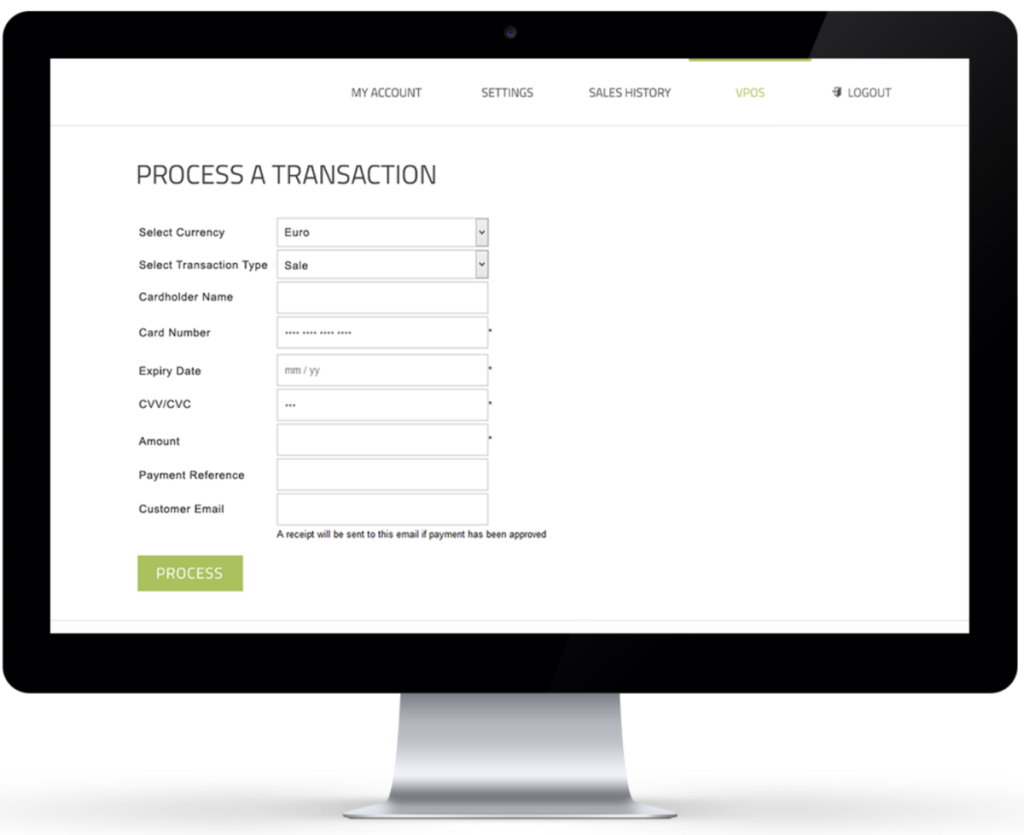

This is when a merchant keys the transaction into a POS or ERP, and the ERP sends the transaction to the Virtual Terminal for them in the background. The Virtual Terminal then becomes a Gateway, which is known as an integrated solution.

This is when a merchant keys the transaction into a POS or ERP, and the ERP sends the transaction to the Virtual Terminal for them in the background. The Virtual Terminal then becomes a Gateway, which is known as an integrated solution.

A VT is when the merchant keys the transaction directly into a website such PayTrace, or Auth.net, etc. All a VT can do is process payments and nothing more. Most VTs can only pass Level II interchange. PayTrace can pass Level III.

A MagTek Reader. It can not do anything if it’s not plugged into a PC or POS System etc.

Terminal/Reader

It is a glorified MagTek Reader – It can accept PIN Codes and some of them have larger screens that allow Signature Capture. They have to be plugged into a computer or ERP, POS, etc (They do not print receipts.)

A Dial Terminal – This is the little black box that sits on the counter. It can connect via a telephone line or via an internet line. Regardless of how it connects, they still call them Dial Terminals. (They print receipts.)

Most of the time, the answer is NO. Dial terminals cannot process at Level III. However, a card reader, like a MagTek (the small black readers often attached to keyboards or the side of monitors), can connect to a virtual terminal that has Level III capabilities. An even better option would be a Level III Data Enhanced payment gateway.

As seen on

Want to talk?

- Call us today 800-672-1292

- Book a free consultation