Percent means per 100

Cent is short for Century or 100

_______________________________________

One Point is 1% or 100 BP

Half a Point is 1/2% or 50 BP

Quarter Point is 1/4% or 25 BP

_______________________________________

100 X 1% = 1

100 X 0.01 = 1

It is the same thing; it’s just % versus decimal.

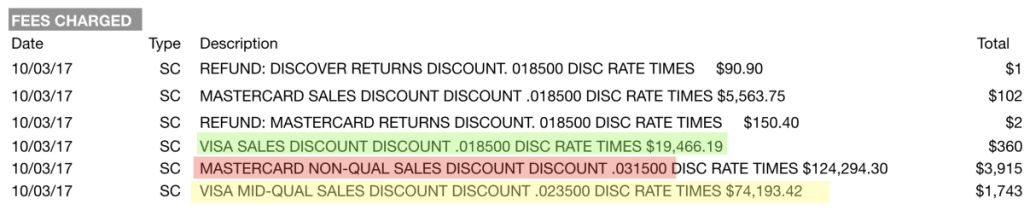

Often, processors will show rates like 0.0253, which look very cheap. However, that is really 2.53%.

Read the first line – “Epicor Payment Exchange is a payment processing service, which is provided by Fiserv.” There is no such thing as a “Payment Processing Service.” There are processors, ISO’s, MSP’s, etc. (See definitions for processors, ISO’s, etc.)

The question here is: Who are they an ISO for? They are not an ISO, as they do not appear in Visa or MasterCard’s database of ISOs. In short, we cannot find any evidence that shows they are approved by Visa or MasterCard to resell merchant processing. Most likely they are simply passing merchants to Fiserv and receiving a kickback, often referred to as “revenue sharing.”

MID (Merchant Identification Number) – This is your processing account number.

Do you need just one MID?

In general, fewer MIDs are better. However, there are situations where you may need or want more than one.

For example, if you have multiple locations that share a single deposit account, you can use one MID. However, the processing networks (Visa, MasterCard, etc.) recommend having a separate MID for each location. This can increase costs, such as statement and location fees.

If your business processes transactions differently across locations—such as “Face to Face” in one and over the phone or via email at another—then you should use separate MIDs.

This ensures that payments are processed at the lowest interchange rate. For instance, “Face to Face” transactions have one set of interchange rules, while “Card Not Present” transactions, such as those over the phone or email, have another.

As seen on

Want to talk?

- Call us today 800-672-1292

- Book a free consultation